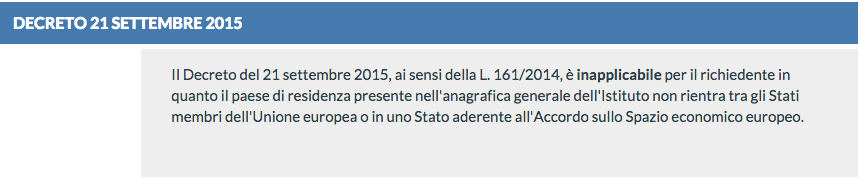

Pursuant to Law No. 161/2014, the Decree dated 21 September 2015 is inapplicable to the case brought by the petitioner, because their Country of residence as listed in the Institute’s general database is not among E.U. Member States, nor it is one of the States adhering to the Agreement on the European Economic Area.

PENSIONS: THE ITALIAN SOCIAL SECURITY AGENCY (INPS) ADMITS TAX EXEMPTIONS. TRIESTE HAS THE RIGHT TO ENJOY THEM, BECAUSE IT IS A STATE OUTSIDE THE EUROPEAN UNION.

Since 1947, the Free Territory of Trieste is a State with clear rights regarding taxation, fiscal administration, pensions and social security. This means that Trieste and its people don’t have to contribute to Italy’s taxation and enormous public (Italian Peace Treaty, Annex X, art. 5). Or to any other State’s, for the matter.

Annex X art. 8 of the Italian Peace Treaty grants that Italian authorities continue paying accrued civil and military pensions to the people of the Free Territory of Trieste. Of course, such payments must comply with Trieste’s own legislation. Also, since Trieste is a State, it has its own taxation. Italy cannot tax pensions in Trieste, because Trieste is fully exempted from the Italian public debt (art. 5 of Annex X).

This is true even after 1954. Indeed, that is when the Italian Government (not the Italian State) started exercising Trieste’s temporary civil administration.

Administration does not mean sovereignty. Trieste maintain its own legislation. The Governments of the United States and of the United Kingdom sub-entrusted the Italian Government with the Free Territory’s temporary civil administration. A mandate they themselves exercised on behalf of the UNSC, pursuant to art. 21 of the Peace Treaty.

The Italian officer that administer Trieste can extend Italian laws to the Free Territory, however, they exercise the Free Territory’s own jurisdiction.

Stil, extending foreign legislation requires compliance with the upper-ranking legal provisions, on penalty of nullity and voidness.

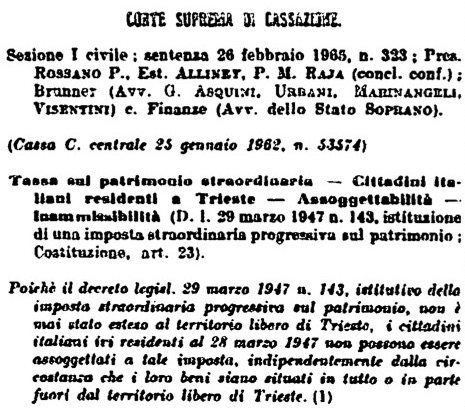

The Italian Supreme Court of Cassation itself fully upholds this principle. Indeed, with judgment No. 323 of 26 February 1965 regarding the inadmissibility of an extraordinary Italian income tax applies even to Italian citizens residing in Trieste.

In particular, the Court clarifies that:

“…the law establishing the tax in question hasn’t been extended to the Free Territory of Trieste, neither by the allied military government not by the current Commissioner General of the Government” …

…and, therefore:

“…it is clear that the tax in question doesn’t apply to the properties themselves for being located in a certain territory, rather, it is because they belong fully and absolutely to a certain subject, and because of this, such tax cannot be enforced respect to those who aren’t subject to the law itself… consequently, since this legislative measure has not been extended to the free territory of Trieste, that is not subject to any tax obligation arising from that law”.

This is the framework to interpret the INPS communication [January 2016] regarding the inapplicability of a Decree issued on 21 September 2015. By analysis, this decree cannot apply to Trieste either, because the Free Territory “is not part of the European Union Member States nor it is a State party to the Agreement on the European Economic Area”.

The Decree of 21 September 2015 is about the Consolidated Law on Income Taxes, as provided with the President of the Italian Republic’s Decree No. 917 of 22 December 1986. And again, Italian income taxes cannot be enforced in another State – as is the Free Territory of Trieste.

Indeed, as denounced by Free Trieste’s European Petition of 15 June 2015, the present-day Free Territory of Trieste is an independent State.

In view of this, the provisions of the Treaties establishing the EU can only apply to Trieste by virtue of the special clause at art. 355 No. 3 TFEU (also 227 No. 4 TEEC, and 229 TEC):

«…to the European territories for whose external relations a Member State is responsible» («ai Territori europei di cui uno Stato membro ha assunto la rappresentanza nei rapporti con l’estero // aux territoires européens dont un État membre assume les relations extérieures»).

In other words, territories that aren’t under a Member State’s sovereignty, but are subject to special provisions of international law.

As is the 1954 special trusteeship mandate over Trieste. The Free Territory is independent since 15 September 1947.

On 23 October 2015 UNSC document S/2015/809 confirmed it once again. The document does also confirm that, since 1954, the Italian Government is responsible of granting law and order in the Free Territory of Trieste, and of protecting its citizens and their rights.

This is why in the Free Territory, pensions including those of the residing Italian citizens, must be relieved from all Italian taxes. The only legitimate taxes are those, yet to be defined, established by Trieste’s Provisional Government, in this role and in the name and on behalf of the Free Territory itself.

In other words: each of Trieste’s about 90,000 pensioners would enjoy a minimum 25% increment to their monthly pension. And this could even be retroactive, given all the illegal Italian taxes levied so far.

This is only one of many “side” effects of full compliance with the 1947 Peace Treaty and of the re-establishment of the rule of law in the present-day Free Territory of Trieste.

The local Italian officers, in breach of Italy’s own laws, are trying to escape it all, going as far as threatening with the suspension of pensions the citizens who call for legality.

This local establishment goes as far as denying a State that is recognized by Italy and protected by the UN.

Mafia-like threatens against the rules-based international order.

Translated from blog “Environment and Legality” – “Ambiente e Legalità” by Roberto Giurastante

Judgment of the Italian Supreme Court of Cassation No. 323 of 26 February 1965: Italian laws cannot be enforced to Trieste unless they are extended by the Commissioner of the administering Italian Government. This is also true for Italian laws on taxation, and the principles applies also to Italian citizens residing in the Free Territory.

RT @TriesteLibera: DE-TAXATION OF #PENSIONS IN THE #FREETERRITORY OF #TRIESTE https://t.co/yXWDadbFzA

#taxes #taxation #FTT #economy http…

DE-TAXATION OF #PENSIONS IN THE #FREETERRITORY OF #TRIESTE https://t.co/yXWDadbFzA

#taxes #taxation #FTT #economy https://t.co/QLxyewRYMN

#DETAXATION OF #PENSIONS IN THE #FREETERRITORY OF #TRIESTE https://t.co/yXWDadbFzA #taxes #taxation #FTT #economy https://t.co/VXhXUUbijL

#DETAXATION OF #PENSIONS IN THE #FREETERRITORY OF #TRIESTE https://t.co/yXWDadbFzA

#taxes #taxation #FTT #economy https://t.co/oZaIJGTVRo

RT @TriesteLibera: How about Italian #pensions in the #FreeTerritory of #Trieste? https://t.co/tYuH35XA8H

#taxes #taxation #FTT #UNTS49 htt…

How about Italian #pensions in the #FreeTerritory of #Trieste? https://t.co/tYuH35XA8H

#taxes #taxation #FTT #UNTS49 https://t.co/R6jNfRMnff

@RobertoGiurasta in English: https://t.co/tYuH35XA8H

DE-TAXATION OF PENSIONS IN THE FREE TERRITORY OF TRIESTE https://t.co/GBQbd6hPhk https://t.co/XRKjN8ONEV